Innovation Reshapes the Future of Detergent Industry in China

Zhang Liping, Huang Liang

Guangzhou Liby Enterprise Group Co., Ltd., China

Abstract

Key words

detergent industry; channel; consumer changing; innovation

It was very unusual in 2018 that consumer confidence was strongly impacted by the adjustment of macro economy, the trade issue of China-USA and collapsing of some part of e-commerce.

Detergent industry was changing in such complex situation.It was studied with statics information both from China Cleaning Industry Association (CCIA) and AC.Nilsson.

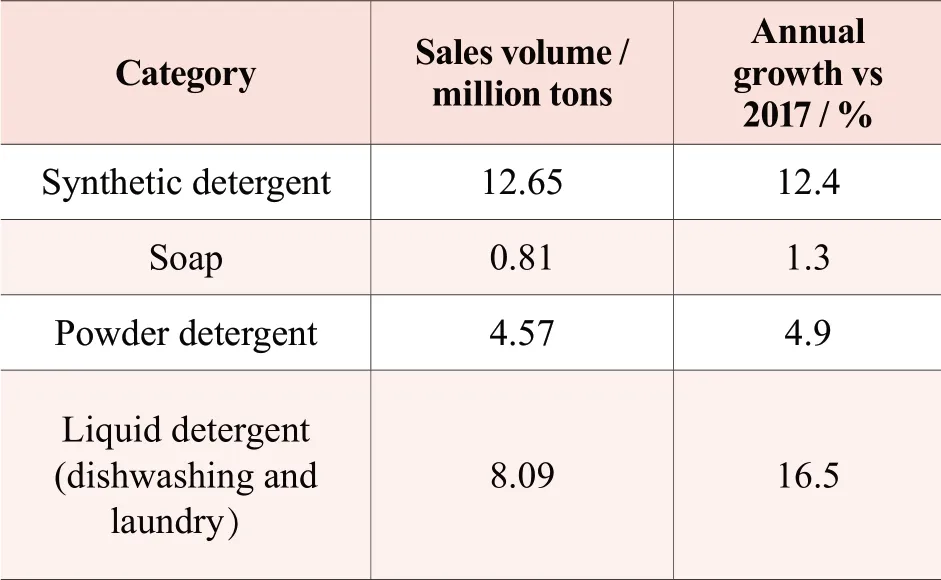

Table 1.Sales volume of detergent industry in 2017

It showed that laundry soap has been in a stagnant phase since 2016.The annual growth of powder detergent decreased to 4.9%, and growth of liquid detergent decreased a little bit, but still remained 16.5%.The data from CCIA might be later than that of the market was, the data from retail audit could reflect the later development of industry.

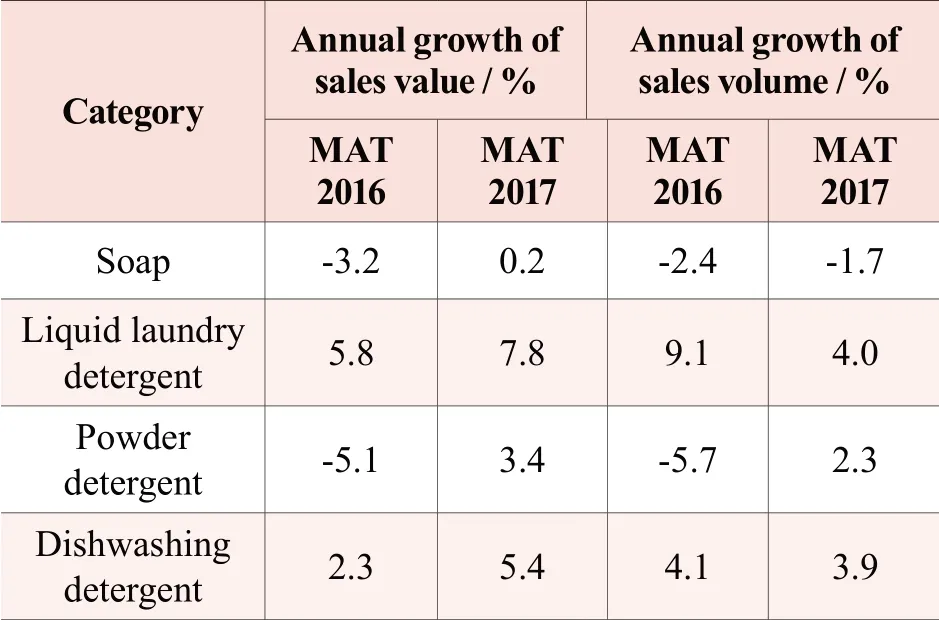

Table 2.Statics data of retail channel

MAT: moving annual total;

MAT 2016: April, 2016- March, 2017;

MAT 2017: April, 2017- March, 2018.

Table 2 showed that the growth of liquid laundry detergent and dishwashing detergent was slow down and industry needs new growth.Refer to the offline channel, the annual growth of sales volume of liquid laundry detergent, dishwashing, and powder detergent achieved 4.0%, 3.9% and 2.3%, respectively.The sales volume of soap bar decreased.All of these main categories faced the great challenge, both on total volume and profit.

There was a big changing in laundry detergent category, from powder to liquid.Table 3 showed the ratio of sales value of liquid to subtotal of powder and liquid in different are in China.

Table 3.The ratio of sales value of liquid to subtotal of powder and liquid

Refer to offline channel in China, the ratio of liquid to subtotal of liquid and powder was over 50%, it was over 72% in hypermarket and over 67% in core city, and was over 52% in county-level cities, which means that liquid laundry detergent has been an alternative in the laundry category and well accepted by consumers.

There were a lot of challenges for detergent industry in 2018, price rising of raw material, increasing of tariff and decreasing of consumer confidence, which impacted the development of detergent industry.The Central government has released a serial of regulation to improve environment, which also impact the supply chain, due to closing of some factory which made pollution.The price of carton rose by 40%, plastics price rose by 10%, some of surfactant price rose by 20%, even filler price rose by 30%, which impacted the industry profit a lot.

Another impact is China-USA trade issue.The import tariff of personal care and detergent were reduced from 8.4% to 2.9%.Some over sea brand , such as Method and the Seventh Generation might made new growth in China.

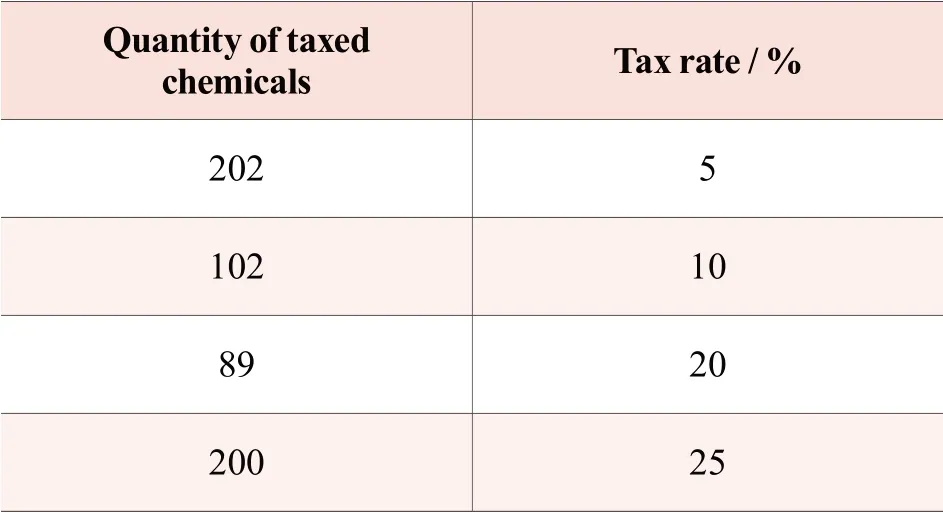

Table 4.Import tariff of part chemical

The import tariff of non-ionic surfactant in detergent industry was raised from 5% to 20%, which also greatly increases the cost of the industry.

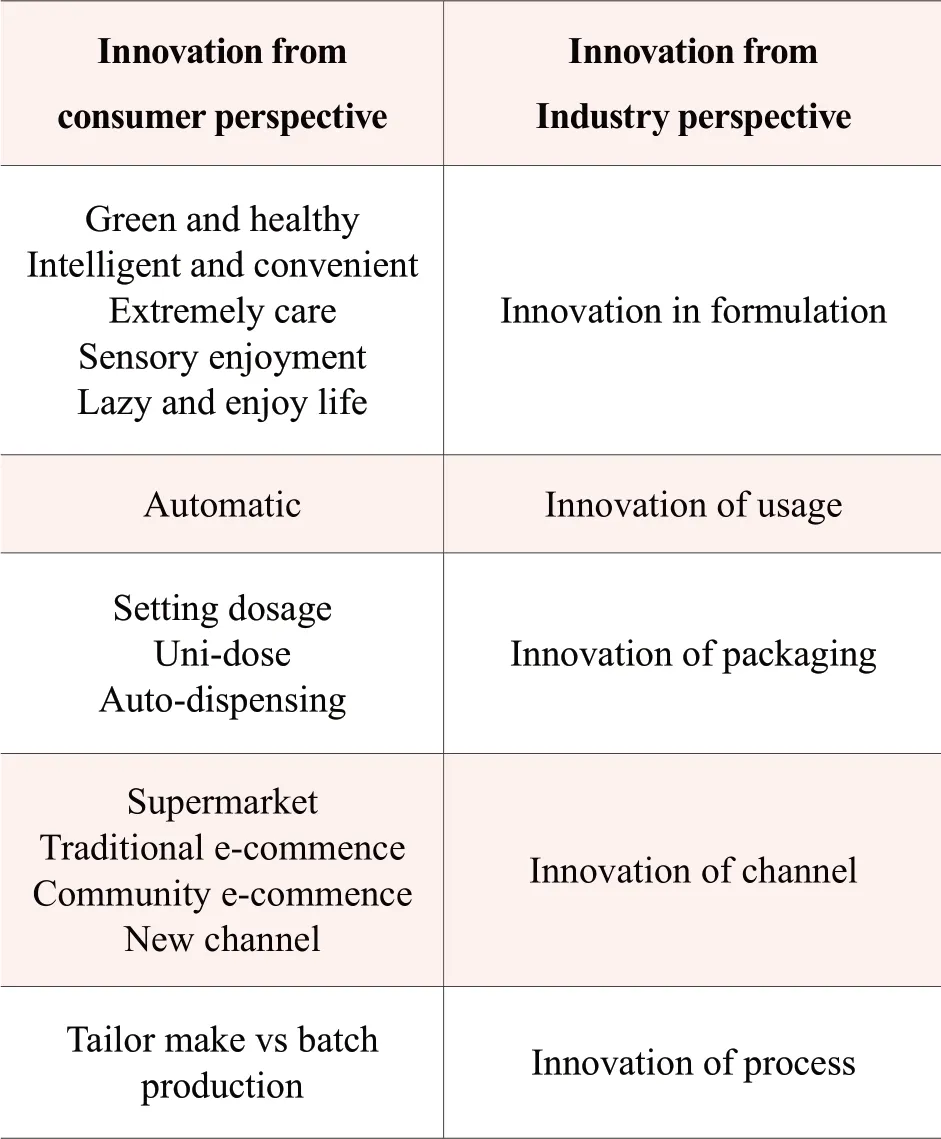

As people born after the 1980s and 1990s grow up, they are becoming the mainstream consumers.They place great importance on social causes and sense of purpose-and they define that purpose twofold and they value more work and life balance and looking for something new.Only the company that continuously delivers innovative products and service to consumers might survive.When people talk about innovation, generally people will consider innovative industry such as AI and intelligent electrical appliances and seldom see innovation in detergent industry.Innovation is an activity which starts from insight and finally creates a new value that can be experienced.So we should learn to look at innovation from the perspective of consumers, not engineers.

Innovation from the perspective of engineers is new formula, including invent of new material, new application of raw material, new formats of products and will seldom consider the innovation in packaging.The same situation exists on packaging engineer.Innovation is not producing a totally different new thing, but creating a new value that can be experienced and improve people's life.

Qianxi chestnut set a very good example in innovation, there is a knife scratch on each chestnut, consumers can eat as long as a pinch, very convenient, greatly improving the happy experience of eating chestnuts.If we look at the innovation of detergent from the perspective of consumers, at least we can find the following ways.

Table 5.Innovation from consumer perspective and industry perspective

There were many successful cases on packaging and process in detergent industry, which were appreciated by consumers.For example, Blue Moon concentrated liquid created a successful way in consumer education and made a new growth in concentrated segment.With the setting dosage of the pump in the packaging, Blue Moon concentrated liquid made consumer realized that concentrated liquid was high detergency and did not need dose much and was not expensive for every load.Similarly, Coca Cola's personalized label has brought new meaning to the products with classic flavors and made consumers love them more.

With more profound insight into human nature and well understanding consumers, we might create new perceived value for consumers.The majority of users and purchasing decision makers of detergent are women, especially when they are married.Married women in China are a very busy group; they need working, caring for children, shopping, cooking, and housekeeping.Therefore, consumers do not have much attention and interaction for detergent.They hope not to spend too much energy on washing, but expect to have the desired effect, or even surprise, to reduce their hardness of housework.

In 2017 and 2018, the growth of China's GPD has declined, and the consumer confidence index has also been impacted to some extent.Which way will detergent industry go, moving forward to the price war or consumption upgrading? Table 6 and Table 7 show the import and export data of detergents in 2017.

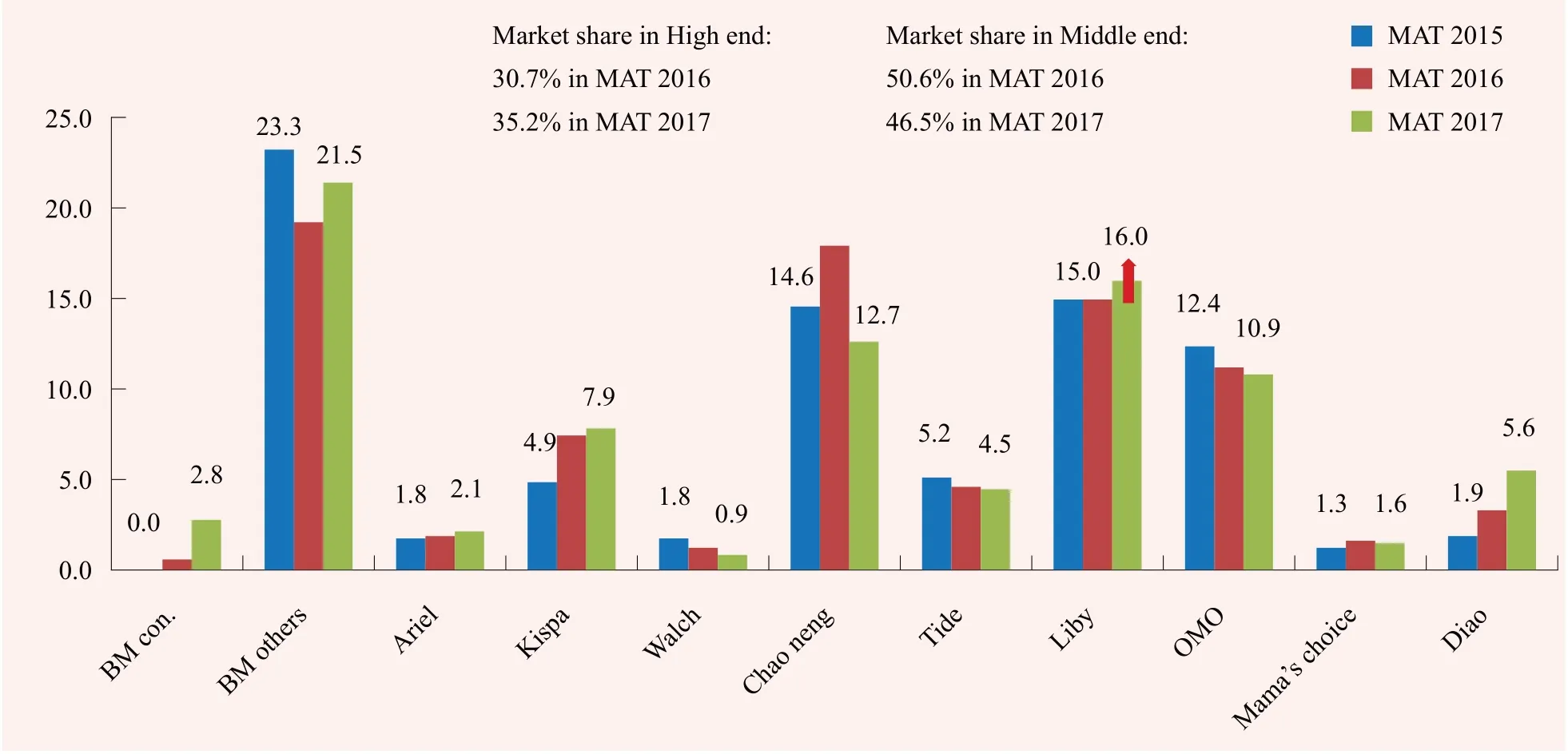

From Table 6 to 7 showed that the growth rate of imported detergents was 2.22 times that of export detergents, and the unit price of imported detergents was 2.56 times that of export detergents.It can be figure out from the unit price that most of the detergents exported were powder detergents, which were conventional powder detergent, while most of the imported detergents were liquid detergent.Based on the above data, the volume of high-end imported products in the detergent market in 2017 had made a rapid growth.Figure 1 showed the development of liquid laundry detergent off line, with sourcing from AC.Nilsson.

Table 6.Export of Chinese detergent in 2017

Table 7.Import of detergent in 2017

Figure 1.Marketing share of liquid laundry detergent brands in Chinese market

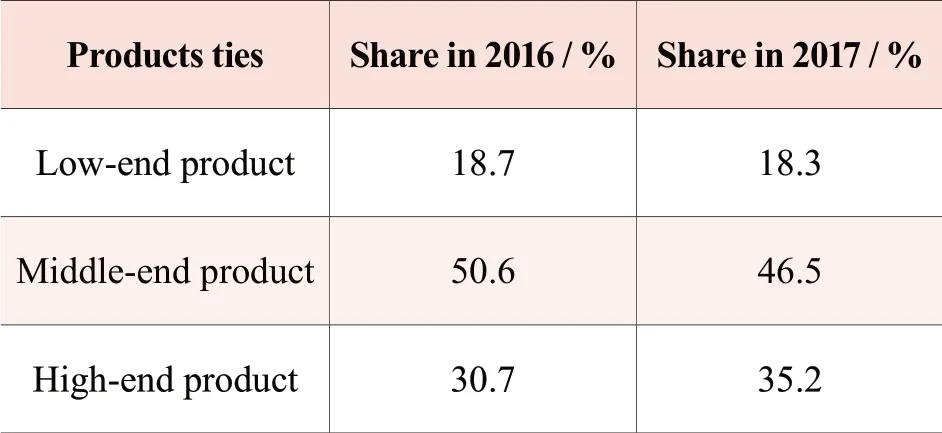

Table 8.Marketing share of products at different position

Date in Table 8 and Figure 1 both proved that the market share of high-end products was 35.2%, that of middle-end products was 46.5% and that of low-end products was 18.3% in MAT 2017; while that of high-end products was 30.7% in MAT 2016; that of middle-end products was 50.6%, and that of low-end products was 18.7%.In the MAT 2016 and MAT 2017, the market share of low-end products and mid-end products were gradually declining, while the market share of high-end products was increasing significantly.

Therefore, the date from domestic market and import and export fully showed that the development of detergents is gradually entering the trend of consumption upgrading.Successful cases of some domestic new products also fully illustrate this trend.For example, Liby company has made laundry powder upgrade to brand new formula, which would not give off heat when it dissolved in water would not hurt skin in handwashing procedure, more importantly, the product did not contain soda, and would not deposit calcium carbonate on the fabric in daily washing, which will keep clothes from yellowing and hardening.This new product made the differentiated from other competitors.Concentrated liquid detergent and uni-dose products provided great convenience, by precise and quantitative dose, to consumers.Liby soap liquid was rich in detergency ingredients from various plant sources and its notable performance of removing oil stains, which delight safety-conscious consumers.Downy laundry perfuming bead was popular among young women.The above cases illustrate the upgrading of consumption and the development of detergent from simple cleaning to more professional care.

The change of sales channels has also promoted the upgrading of detergents.The annual growth rate of laundry detergents online is 160%, and more than 85% of uni-dose detergent sales come from online.Online marketing is more suitable for new products.

Therefore, the development of detergents in the future will go to high-end, and more segment.The characteristics of the product may show that fine design, user experience first, reasonable price for market segmentation.Systematic innovation is the driving force to promote the new trend.We can expect that in the future, most of big brand will continue to invest more in innovation and pay more attention to the needs of consumers.

China Detergent & Cosmetics2019年3期

China Detergent & Cosmetics2019年3期

- China Detergent & Cosmetics的其它文章

- Experimental Design of Cosmetics Human Efficacy Evaluation

- Application Research of Bamboo Vinegar in Daily Chemicals

- Determination of Paeonol in Detergent by High Performance Liquid Chromatography

- Fluorinated Surfactants and Fluorinated Polymer Materials (III): Personal Opinion on the Problems of PFOS

- A New Method to Improve the Product Stability and Performance of Soap-based Cleanser at Two Different Temperatures

- Safety and Risk Management of Cosmetic Products