Study on Improving Development Strategies of New Rural Social Pension Insurance System in Heilongjiang Province

Zhang Qi-wen, Li Hui-fang, and Gao Li-na

College of Economics and Management, Northeast Agricultural University, Harbin 150030, China

Introduction

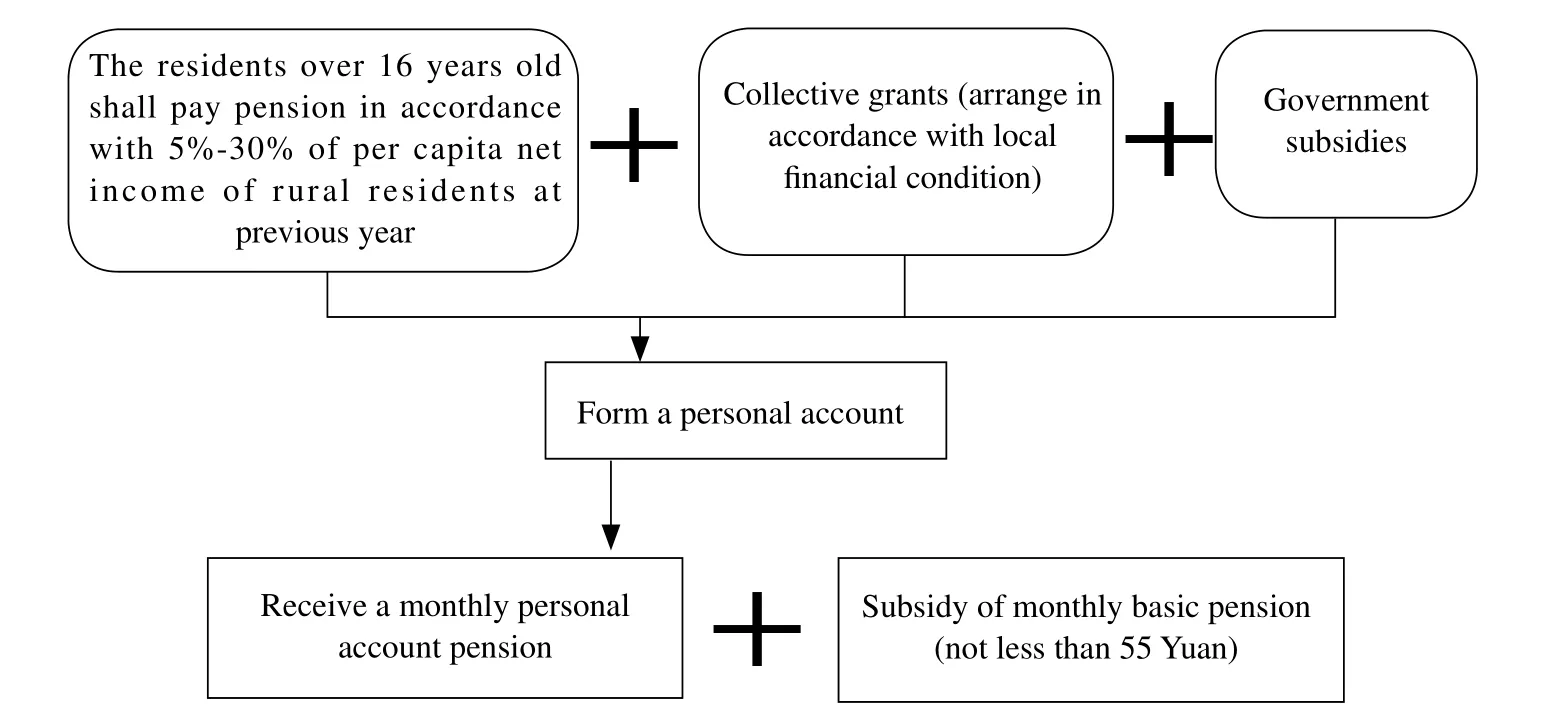

In accordance with the reference standard made by the United Nations for society with aging of population,China has entered into the stage with aging of population in 2005 and already gradually showed a trend of further accelerating aging. Therefore, the pension issue of rural residents has become the most important issue that must be faced and solved. In September 2009, the State Council issued the Guidance on Carrying Out New Rural Social Pension Insurance Pilot (hereinafter referred to as the "Guidance"), and in December 2009, the new rural social insurance pilot in Heilongjiang Province (hereinafter referred to as the "new rural social insurance")is off i cially started.The state approved 14 counties (cities, districts)in Heilongjiang Province as the first batch of the new rural social insurance pilot units, such as Yilan County,Yian County, Ningan County, etc. On the basis of the principle of "basic security, wide coverage, fl exibility,sustainability", the new rural social insurance pilot implements the way of combining government subsidies, collective grants and individual contributions in one aspect of payment, and insists the principle of government-led and voluntary participation of the rural residents in the way of insured. The insured enjoy different treatments according to the economic levels in different regions, but the pension benefi ts shall be not less than local minimum living standard.

The "Guidance" provides a framework blueprint and development way for the improvement of the new rural pension insurance system in Heilongjiang Province.However, the implementation of new rural pension insurance system encounters some difficulties in the process of promotion. It can only realize the "elderly will be looked after properly" of rural residents and promote the faster and better development of the rural economy by properly handling with these problems, therefore, it is essential to carry out indepth analysis to the difficulties and problems faced in the study of rural social pension insurance protection and develop appropriate countermeasures.

Fig. 1 New rural pension insurance system framework

Development Status of New Rural Social Pension Insurance in Heilongjiang Province

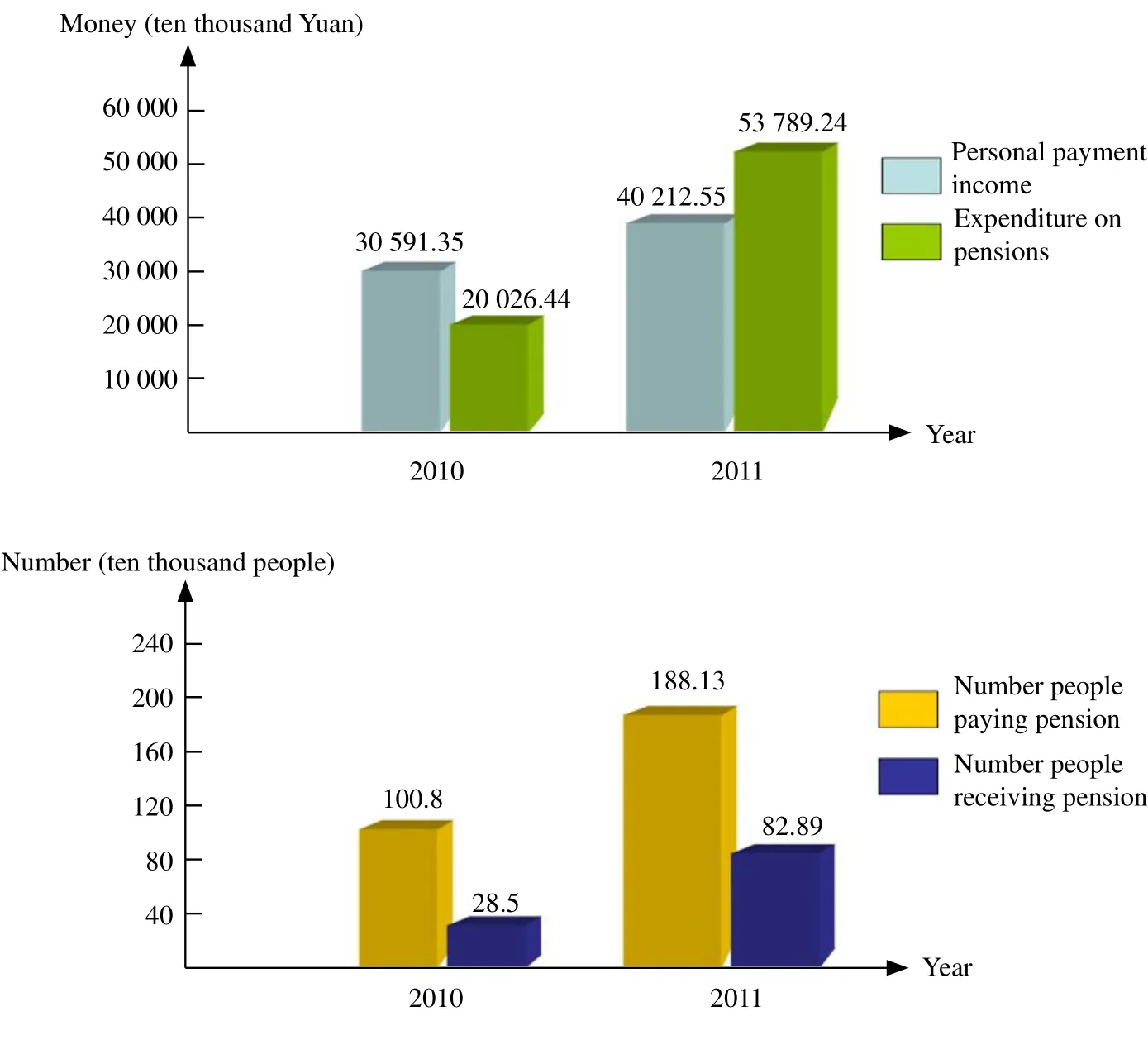

Heilongjiang Province is a major agricultural Province and rural residents account for a large proportion.Thus the farmers' pension issue has been the primary problem to be solved in Heilongjiang Province, and the implementation of the new rural social pension insurance has eased the tensions. In December 2009,the new rural social pension insurance pilot was started in 14 counties (cities, districts)in Heilongjiang Province. People did not pay pension at the current year. The pension of December in 2009 was issued at the beginning of 2010. In 2010, the pilot was expanded to 27 counties (cities, districts). On July 1, 2011, the third batch of new rural social pension insurance pilot in 59 counties (cities, districts)was started. Until July 1, 2011, there had been 86 new rural social pension insurance pilot counties in Heilongjiang Province.In pilot areas, the total agricultural populations were 12.53 million, accounting for 70.43% of the total agricultural population in Heilongjiang Province,covering 1 627 300 agricultural populations over the age of 60, accounting for 60.17% of the total population with the same age stage in Heilongjiang Province. The number of insured people in the first two batches is 3 618 300. Up to now, there have been 1 286 300 people have received pension, a total of 803 million Yuan pensions been issued. Although the new rural social pension insurance is with a good start in Heilongjiang Province, our goal is to reach full coverage, so that each farmer will be looked after properly when they grew old, so there are still some diff i culties and problems that need to be addressed.

Problems Existed in New Rural Social Pension Insurance of Heilongjiang Province

The economic development of Heilongjiang Province is at the middle level among the country and the gross national product ranked 16 in 2011. Heilongjiang Province covers a vast territory, and the economic and social development level is quite different over different regions. Some of the problems and diff i culties reflected by the new rural social pension insurance pilots have a certain typicality and representativeness.

Insured enthusiasm of young and middleaged farmers is not high

Currently, the insured objects with the highest enthusiasm in Heilongjiang Province are the people over 60 years old who will be able to enjoy the treatment after paying the pensions, while the majority of people below 45 years old held a wait-and-see attitude. As for the pension problems of the elderly population in rural areas of Heilongjiang Province,family pension accounts for the absolute dominance.The reasons are shown as below: fi rstly, farmers under the age of 45 are in the prime of life, so most of them do not think too much to the pension problem, so they do not care about the new rural social pension insurance policy; secondly, the new rural social pension insurance system fails to connect the basic pension with payment period, and the basic pension is 55 Yuan regardless of payment period, the young and middle-aged farmers feel uneconomical; thirdly, the protection level of new rural social pension insurance system is lower. If the personal account pays 100 Yuan a year for 15 consecutive years, the farmers can only receive about 15 Yuan per month until 60 years old,plus a minimum 55 Yuan of basic pension, so farmers can receive a pension of 70 Yuan per month. Through the analysis from the qualified insured population in Heilongjiang Province. It is the younger, the lower insurance rate. While the young and middle-aged people in Heilongjiang Province accounts for 82.87%,so it will seriously hinder the promotion process of the new rural social pension insurance in Heilongjiang Province, if the problem can not be solved.

Fig. 2 Basic information of rural pension in Heilongjiang Province from 2010 to 2011

Insuff i cient fi nance capital subsidy in parts of counties

The local financial subsidy policy in Heilongjiang Province: when rural residents pay the pension, the local financial department gives the insured person a fixed subsidy. As for the rural severe disabled groups with payment difficulties, the governments of pilot counties (cities, districts)will withhold parts or all of the minimum standard pension insurance.The financing of the rural pension insurance funds mainly depends on the inputs of departments at above provincial level, and the county level financial shall provide supporting. The financial investment of Heilongjiang Province is low in China, which is not a problem to counties and cities with better economic conditions, while a large pressure for the predominantly agricultural counties and the counties with lower economic development level, so it is difficult to implement. For example, about 165 000 farmers meet the insured conditions in Ningan County of Heilongjiang Province, if generally choose the insured standard of 100 Yuan, individual payment 50% and government subsidy 50%, Ningan City shall pay more than 3 million Yuan subsidies, while Ningan is a small agricultural city, the long-term fiscal revenues are about 130 million Yuan and exceed 400 million at recent three years, so it is with fi nancial diff i culties and the pressures to pay 3 million Yuan subsidies is larger. Yilan County is with the similar condition.

Unsound pension fund working bodies and lack of management

Firstly, Heilongjiang Province is a major agricultural Province and rural population account for a large proportion. While the objects benef i ted from new rural social pension insurance are a large number of rural populations, so it needs to carry out work to thousands of households. In consideration of large amount of works, it needs long-term and effective operation and management, while the positions in managing body at country level in Heilongjiang Province is insuff i cient,and the workers are with poor stability and frequent job changes, which severely restricts the development depth of the work. To sum up, the managing capacity of Heilongjiang Province fails to meet the current demand. Secondly, the new rural social pension insurance fund management in Heilongjiang Province is lack of system specif i cation. Due to the lack of the management system, the management risk of the rural pension insurance fund is diff i cult to effectively curb.Meanwhile, the network information management system construction at county level in Heilongjiang Province is lagging behind, management techniques force is relatively weak, so that it affects the normal operation of the rural social pension insurance and safety management of the social security fund in a certain extent. In short, if the management of the pension insurance fund in Heilongjiang Province is not strengthened, it will seriously impede the promotion and development of new rural pension insurance and cause adverse impact to the establishment of the rural social pension security system in Heilongjiang Province.

Suggestions on Improving New Rural Pension Insurance Policy of Heilongjiang Province

Enhance the awareness of the young and middle-aged farmers to new rural social pension insurance

Firstly, break the traditional "family pension" concept in Heilongjiang Province, and the government departments shall provide correct guidance, so that farmers can understand that the way to rely on the land and children can not really meet the needs and fully realize the importance of socialization of pension insurance, then we can help the farmers to break the shackles of traditional ideas. The real change in farmers' ideas also contributes to the promotion of new rural pension insurance. Secondly, it is necessary to improve the relevant aspects of the new rural pension insurance system, so that farmers feel that the system is reasonably practicable, indeed allowing them"elderly will be looked after properly", eliminating the fear of attacks from behind, increasing their appeal, especially improving the enthusiasm of young and middle insured crowd in Heilongjiang Province,so as to greatly improve the overall insured rate of Heilongjiang Province to reach the target of full coverage.

Financial subsidy policies shall be implemented according to local conditions, reject"imposing uniformity in all cases"

Although the gross national product of Heilongjiang Province ranks in the middle among the whole country, Heilongjiang Province is a major agricultural Province with large number of population and large proportion of rural residents, so the ranking of per capita gross national product of Heilongjiang Province is not very optimistic. The state shall firstly take into account this point so as to increase the support for some of the special Provinces as increasing the proportion of social security expenditure on fiscal revenue. Secondly, Heilongjiang Province shall give the poor counties funds subsidies according to the actual situation, including Tangyuan County, Lanxi County of Heilongjiang Province, etc. For example,the government gives some additional subsidies to underdeveloped areas to reduce the stress and reduce some the hindering to implement new rural social pension insurance in terms of capital as much as possible. Meanwhile, the government shall provide more preferential policies to encourage raising funds by themselves and allow developed areas to try to market-oriented operation, so that the new rural social pension insurance in Heilongjiang Province can be carried out steadily.

Improve working agencies and strengthen management

Expand and improve the size of personnel force at county level in Heilongjiang Province. The countylevel government in Heilongjiang Province shall increase the input of manpower, material and fi nancial resources, and the township should determine the full-time staff in the labor and social security firms to maintain relatively stable staff. In addition, it shall also establish the long-term mechanism to guarantee the funding of new rural social pension insurance in Heilongjiang Province to ensure that all expenses of the social security agencies personnel shall be arranged by the government budget, but not extract management fee from the funds for new rural social pension insurance. The government shall also conduct ideological education and systematic business training on a regular basis according to work requirements to enhance the sense of responsibility of the staff and ensure that the new rural social pension insurance work can be carried out in Heilongjiang Province with reliable guarantee of talent. II. Strengthen the management of rural social pension insurance fund. Firstly, improve the management level of new rural social pension insurance fund institutions in Heilongjiang Province and improve the operational efficiency of the funds. Secondly, formulate rural insurance fund restrictive investment policy and broaden the investment channels and try to make capital appreciation on the basis of a store of value in rural insurance fund. Under the promise of ensuring the safety of the funds, part of the rural pension funds can be given to the professional investment company to make investment to improve the appreciation rate of funds. As for the management of investment risk,it can create investment risk rating mechanism and organize experts to evaluate fund investment risk in order to reduce investment risk. All of theses are important guarantees to promote the new rural social pension insurance.

Conclusions

Through the analysis of the existing problems on new rural social pension insurance of Heilongjiang Province and combining with the current development of Heilongjiang Province, this paper summarized the problems that shoud be drawn attention to in the process of implementation and improved the policyrelated recommendations for the establishment of new rural pension insurance. It also provided references for the gradually expanding new rural pension insurance pilots among the country. It will gradually achieve nationwide coverage in 2020 and enable farmers’life raise to a new stage. The rural pension insurance is a solid safety net prepared by the government for farmers and the great cause that is concerned about and actively struggled with by the government and the whole social. It will be bound to provide strong supports for comprehensive, coordinated and sustainable implementation of the "scientific outlook on development" to establish and continuously improve the rural pension insurance system suitable for China's national conditions, and will also promote the sustained, rapid, harmonious and healthy development of the national economy.

Chen S J. 2009. Research on fi scal support for new rural social pension insurance. Academic Communication, 7: 83-86.

Chen S J. 2009. Analysis on the state of new rural social pension insurance pilot in Heilongjiang. Theory Research, 5: 99-101.

Fu D Z. 2007. Analysis on the institution of China's rural social pension security system. Journal of Jiangxi University of Finance and Economics, 2: 53-56.

Han J J, Jin X Z. 2009. Promoting the construction of the new rural social pension system. Guangming Daily Press.

Li J G. 2007. The development direction and emphasis of new rural pension insurance system. Decision Consulting Communications, 6:14.

Liu C P, Yin B M, Xie T. 2008. A study on the new rural social pension system in China. China Social Sciences Press. Beijing. pp. 39-40.

Lin Z F. 2007. Social security fund management. Science Press. pp.30-32.

Liang H. 2008. The ageing population and the study on the old-age insurance in China's rural areas. Shanghai People's Publishing House. Shanghai. pp. 45-47.

Mi H, Yang C Y. 2008. The basic theoretical framework study of the social pension security system in rural society. Guangming Daily Press.

Mou F. 2005. Proposals concerning improving old-age insurance system in our rural areas. Journal of Central University of Finance and Economics, 5: 10.

Sun L. 2009.1 Accelerating the establishment of a new type of rural pension insurance system. China Information News.

Journal of Northeast Agricultural University(English Edition)2012年4期

Journal of Northeast Agricultural University(English Edition)2012年4期

- Journal of Northeast Agricultural University(English Edition)的其它文章

- Effects of Row-Spacing on Canopy Structure and Yield in Different Plant Type Rice Cultivars

- Effects of Subchronic Aluminum Exposure on Amino Acids Neurotransmitters in Chicken Brain

- Effects of Different Cropping Patterns of Soybean and Maize Seedlings on Soil Enzyme Activities and MBC and MBN

- Study on Classification and Genetic Diversity of Kentucky Bluegrasses by Using RAPD Markers

- Effects of Phosphate Fertilizer on Cold Tolerance and Its Related Physiological Parameters in Rice Under Low Temperature Stress

- Storage System Design Scheme in Virtualization Construction